Master Ethena’s Points Season 2: Unleash Profits with Pendle PT and YT Token Strategies

Introduction

As decentralized finance (DeFi) evolves, Ethena stands out with its innovative approach to stable and yield-generating digital assets. At its core is USDe, a synthetic dollar pegged to the US dollar, collateralized with staked Ethereum (stETH) and maintained through delta-hedging strategies. This unique mechanism ensures stability and high yields, making USDe an attractive option for some investors.

In this article, we’ll explore top strategies for maximizing profits during Ethena’s Points Season 2 using Pendle’s Principal Tokens (PT) and Yield Tokens (YT). From securing fixed yields to gaining leveraged exposure on the value of the airdrop, these strategies will help you make the most of the opportunities Ethena and Pendle Finance offer.

Disclaimer: This information is for educational purposes only and does not constitute financial advice. We are not financial advisors, and you should consult with a professional before making any investment decisions.

Ethena Points Season 2: An Overview

Ethena Labs has launched the second season of their points campaign, known as the Sats Campaign, starting from April 2, 2024, and running until September 2, 2024, or until the USDe supply reaches $5 billion. This season marks a shift from the previous "Shards" system to "Sats," reflecting the campaign's new focus on Bitcoin (BTC) as the primary asset.

Key Features of Season 2

Duration and Goals:

The campaign spans five months, ending on September 2, 2024.

The campaign will conclude early if the USDe supply hits $5 billion.

Enhanced Rewards:

New Integrations and Partnerships:

Ethena has partnered with MakerDAO and Morpho to offer higher rewards and increased liquidity pools.

New Pendle pools on the Mantle ecosystem, featuring lower gas fees and additional ways to earn rewards, are a significant highlight.

Airdrop and Token Distribution:

An airdrop of 750 million ENA tokens, representing 5% of the total supply, was distributed to USDe holders on April 2, 2024. The Season 2 airdrop is widely expected to be of a similar magnitude.

Participation Opportunities

Participants can engage in multiple ways, such as holding USDe in various positions, providing liquidity, or using USDe as collateral. The campaign offers numerous opportunities to earn Sats and Eigenlayer points, incentivizing users to contribute to the ecosystem's growth actively (Bitrue Support) (Bittime) (Mirror).

Ethena Points Season 2 is designed to expand the protocol's user base and enhance the profitability of its stablecoin, USDe. With attractive rewards and strategic partnerships, this season promises to be a significant milestone for Ethena Labs and its community (Gate.io) (Bittime) (Mirror).

Understanding Pendle PT and YT Tokens

Pendle Finance offers a unique approach to yield management by tokenizing yield-bearing assets into two distinct components: Principal Tokens (PT) and Yield Tokens (YT). This tokenization allows for advanced strategies and greater flexibility in managing yield.

Principal Tokens (PT)

PT represent the principal component of a yield-bearing asset. When you purchase a PT, you are essentially buying the right to reclaim the underlying asset at maturity. PTs are designed for users who want to lock in a fixed yield over a specified period. This means that by holding PTs until they mature, users can secure a predetermined return, providing stability and predictability in their investments.

Key Characteristics of PT:

• Fixed Yield: PTs provide a set return if held until maturity.

• Underlying Asset: At maturity, PTs can be redeemed for the underlying asset.

• Risk Mitigation: Ideal for those looking to avoid the volatility associated with variable yields.

Yield Tokens (YT)

YTs represent the yield component of a yield-bearing asset. By holding YT, users receive the yield generated by the underlying asset over time. This allows users to speculate on the future yield of an asset. If the yield produced by the asset exceeds the market’s expectations (Implied APY), YT holders profit from the difference. YT is particularly attractive in bullish markets where the underlying asset’s yield is expected to increase.

Key Characteristics of YT:

• Variable Yield: YT holders benefit from the yield generated by the underlying asset until maturity.

• Market Speculation: Users can profit if the actual yield exceeds market expectations.

• Time-Dependent Value: The value of YT trends towards zero as it approaches maturity, making timing crucial.

How They Work Together

Pendle’s ecosystem allows users to trade PT and YT independently, enabling a range of strategic opportunities:

• Fixed Yield Strategy: Purchase PT to secure a known return.

• Long Yield Strategy: Buy YT to speculate on yield increases.

• Combined Strategy: Balance a portfolio with both PT and YT to manage risk and optimize returns.

By leveraging these tokens, Pendle provides users with the tools to navigate different market conditions, whether they seek the security of fixed returns or the potential upside of variable yields. This flexibility makes Pendle an essential platform for sophisticated yield management in the DeFi space.

Strategy 1: Holding PT-ENA for Stable Returns

The simplest and most straightforward strategy in Points Season 2 is holding Principal Tokens of ENA (PT-ENA). This strategy is particularly appealing if you are looking for stable returns with minimal complexity and uncertainties. Here’s an overview of why this strategy is effective:

Current APY

As of the latest update, holding PT-ENA offers an annual percentage yield (APY) of 82.04%. This high yield is one of the most attractive aspects of this strategy, especially given the relative simplicity of holding PT-ENA.

Benefits of Holding PT-ENA

1. Simplicity: This strategy is the easiest to understand and implement. By holding PT-ENA, you are guaranteed a fixed return without the need to actively manage your investment or navigate complex trading mechanisms.

2. Lower Risk: Compared to strategies involving Yield Tokens (YT) or other trading activities, holding PT-ENA carries fewer unknowns. You are not exposed to the variable yields or market fluctuations that can impact the performance of other strategies. This makes it a safer option for conservative investors.

3. No Active Management Required: Once you purchase PT-ENA, there is no need for further action until maturity. This passive investment approach is perfect for those who prefer a “set it and forget it” strategy, freeing up time and reducing the need for constant market monitoring.

Risks

Price risk. The main risk associated with PT-ENA is due to fluctations in price of ENA itself. If you were planning on holding ENA anyways this is not an issue, but if are benchmarking your results against holding USDC or ETH, then you may want to consider a hedged version of this strategy using perps (see below for an example).

Smart contract risk. When using any DeFi protocol, there is always smart contract risk. In this case one is exposed to smart contract risk via Pendle as well as Ethena.

Implementation

To implement this strategy, simply purchase PT-ENA tokens through the Pendle. Ensure that you hold these tokens until maturity to benefit from the full yield. The process is straightforward, involving minimal steps and decisions compared to more complex DeFi strategies.

Probabilistic Analysis

The main uncertainty with this strat is the price of ENA at maturity of PT-ENA. Hence we consider three different cases to which we assign equal probabilities of 1/3 each - the bull case, the neutral case and the bear case.

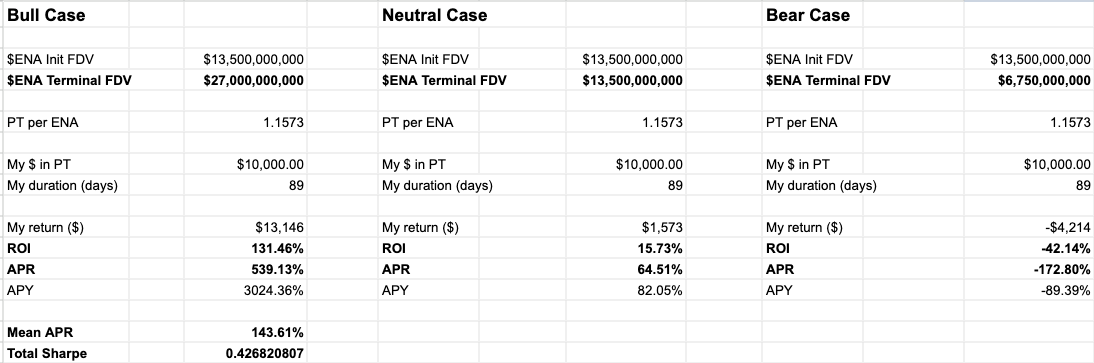

Below is a snapshot of the inputs and the computed ROI for each case as well as the mean APR of the strategy and aggregate Sharpe over all three scenarios:

As you can see, although the strat has huge upside, it also has a huge downside and the overal sharpe of ~ 0.43 is lower than what we are personally comfortable with.

Conclusion

Holding PT-ENA is the simplest and most stable strategy available during Points Season 2. With an attractive APY of 82.04% and minimal risk, this approach is perfect for investors seeking reliable returns without the complexities of active trading or yield speculation.

Strategy 2: Holding PT-ENA with Perpetual Futures Hedging for Delta Neutrality

For those of you seeking to maximize your returns while managing risk, a more advanced strategy during Points Season 2 involves holding Principal Tokens of ENA (PT-ENA) and hedging with perpetual futures for delta neutrality. This strategy not only provides a stable return but also takes advantage of funding rates from perpetual futures, potentially increasing overall yields.

Overview of PT-ENA with Perpetual Futures Hedging

This strategy involves holding PT-ENA to secure a fixed yield while simultaneously hedging against price fluctuations of ENA using perpetual futures contracts. The goal is to achieve delta neutrality, where the gains from holding PT-ENA are offset by the movements in the futures market, thus neutralizing the impact of price changes on the overall investment.

Current APY

By holding PT-ENA, investors can lock in an annual percentage yield (APY) of 87%. Additionally, hedging with perpetual futures allows investors to collect the funding rate, which can add up to anywhere from 30% to 150% APR, depending on market conditions. This combined yield makes this strategy attractive for those willing to manage their positions actively.

Benefits of the Strategy

1. Risk Management: The primary benefit of this strategy is that the delta neutrality helps manage the risk of price fluctuations. By offsetting the potential gains or losses from PT-ENA with corresponding futures positions, investors can stabilize their returns regardless of market volatility.

2. Funding Rate Income: Perpetual futures contracts often come with funding rates paid by traders holding long positions to those holding short positions. In a bullish market, these funding rates can be quite high, adding an attractive income stream to the overall yield which offsets the increased capital requirements of this strategy.

Drawbacks and Considerations

1. Active Management Required: Unlike the passive strategy of simply holding PT-ENA, this approach requires more active management. Investors must monitor their futures positions and supplied margin to avoid liquidations.

2. Fluctuating Funding Rates: While the funding rate can enhance returns, it is not guaranteed and can fluctuate based on market conditions. In some cases, the rate may decrease or even become negative, potentially impacting the overall profitability of the strategy.

3. Increased and Unpredictable Capital Requirements: Hedge with futures requires the posting of margin which can dilute the APR of the strategy. This becomes especially significant if the price of ENA increases significantly, requiring you to post more margin to cover your short position.

Implementation

To implement this strategy, you would:

1. Purchase PT-ENA tokens through the Pendle platform to secure the fixed yield.

2. Open perpetual futures positions on a suitable exchange to hedge against price fluctuations of ENA, aiming to achieve delta neutrality. We like hyperliquid (referral link).

3. Regularly monitor and your futures positions to ensure that the portfolio meets margin requirements even in the case of larger price moves.

Probabilistic Analysis

As before we three different cases to which we assign equal probabilities of 1/3 each - the bull case, the neutral case and the bear case. Since this strategy is hedged the price fluctations of ENA won’t a huge driver of varation. However we do expect them to impact funding rates and capital requirements. The bull scenario will lead to a larger funding rate but also larger margin requirements than the neutral and bear scenarios.

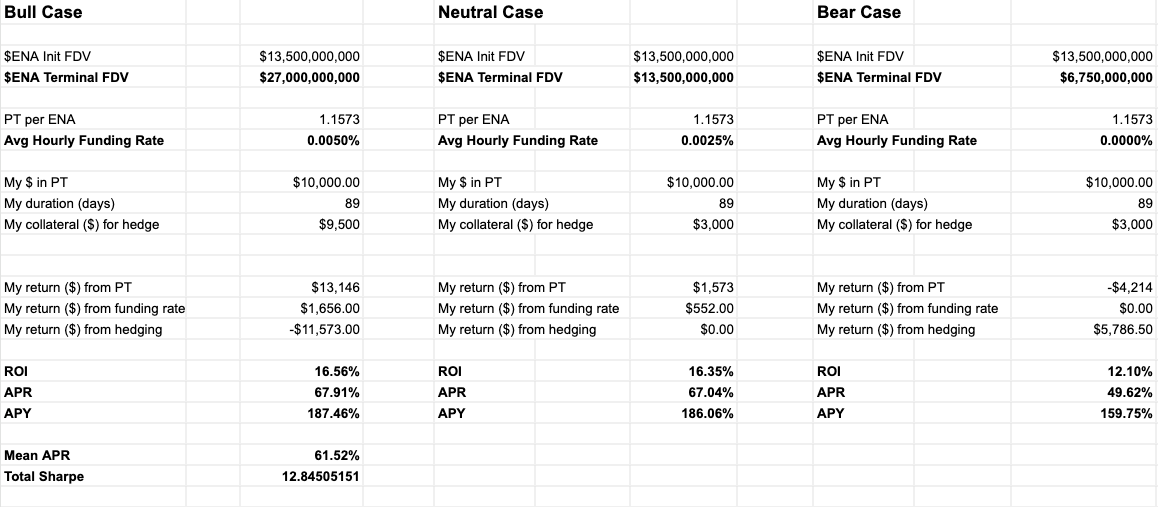

Below is a snapshot of the inputs and the computed ROI for each case as well as the mean APR of the strategy and aggregate Sharpe over all three scenarios:

As you can see, although the strat has lower upside than the unhedged version, but it also has much better downside protection leading to more predicatble returns. The Sharpe of 12.84 is truly excellent. This strategy is one of our favorites for this reason.

Conclusion

Holding PT-ENA with perpetual futures hedging for delta neutrality is a more sophisticated strategy that can significantly boost risk adjusted returns during Points Season 2. While it requires a more active management and a thorough understanding of futures markets, the potential for enhanced risk adjusted returns makes it a potentially attractive option for more experienced investors. By carefully balancing the benefits and drawbacks, this strategy can help investors maximize their returns while effectively managing risk.

Strategy 3: Going Long on YT-USDe on Pendle

For those of you looking to maximize returns during Ethena’s Points Season 2, going long on Yield Tokens (YT) of USDe on Pendle is a compelling strategy. This approach allows you to benefit from both the yield generated by USDe and the potential rewards from the Points Season 2 airdrop.

Potential Returns

1. Leveraged Yield Play: Buying YT-USDe allows investors to leverage their exposure to both the yield and points accrual of USDe. If the yield or points generated by USDe is above market expectations, the returns on YT-USDe can be substantial.

2. Airdrop Value: This strategy leverages the anticipated value of the Ethena airdrop, which is expected to be up to 5% of the total ENA supply. The yield from YT-USDe includes these additional points, enhancing potential returns.

Benefits of YT-USDe

1. High Potential Yield: The primary benefit of this strategy is the high potential yield from both the USDe yield and the additional points from the airdrop. This dual-source of yield can significantly boost returns.

2. Participation in Points Season 2: Holding YT-USDe allows investors to directly participate in Ethena’s Points Season 2, potentially earning more points and increasing their share of the airdrop rewards.

Risks and Unknowns

Airdrop Percentage: The exact percentage of the airdrop and the total number of tokens distributed can vary, affecting the overall returns.

Total Sats Minted: The total number of Sats produced and available for distribution during Points Season 2 is another variable that can impact potential returns. The exact number of Sats minted will determine the overall reward pool and how it is distributed among participants.

Price of ENA. The value of the points will also depend on the FDV of Ethena which fluctuates with the value of ENA. If the price of ENA drops, this strategy can incurr loses.

Suprise Delays Regarding Airdrop. A major risk in points farming is the timing around when you can convert your points to something liquid that you can sell (in this case ENA). Teams can arbitrarily delay this and there is no great way to hedge against this risk except doing one’s own research and carefully monitory team announcements.

Implementation

Purchase YT-USDe: Acquire YT-USDe tokens on the Pendle platform. Ensure you understand the current market conditions and the potential yield.

Monitor Market Conditions: Keep track of the market price of YT-USDe and any updates regarding the airdrop and the yield generated by USDe. If at some point you wish to exit the trade you have the option of selling your TY-USDe tokens via Pendle.

Wait for Maturity. If you decide to buy and hold TY-USDe then you wait until maturity and cash out once you receive your points and yield.

Probabilistic Analysis

As in our first strategy, the main uncertainty with this strat is the price of ENA at maturity of YT-ENA. Hence we again consider three different cases to which we assign equal probabilities of 1/3 each - the bull case, the neutral case and the bear case.

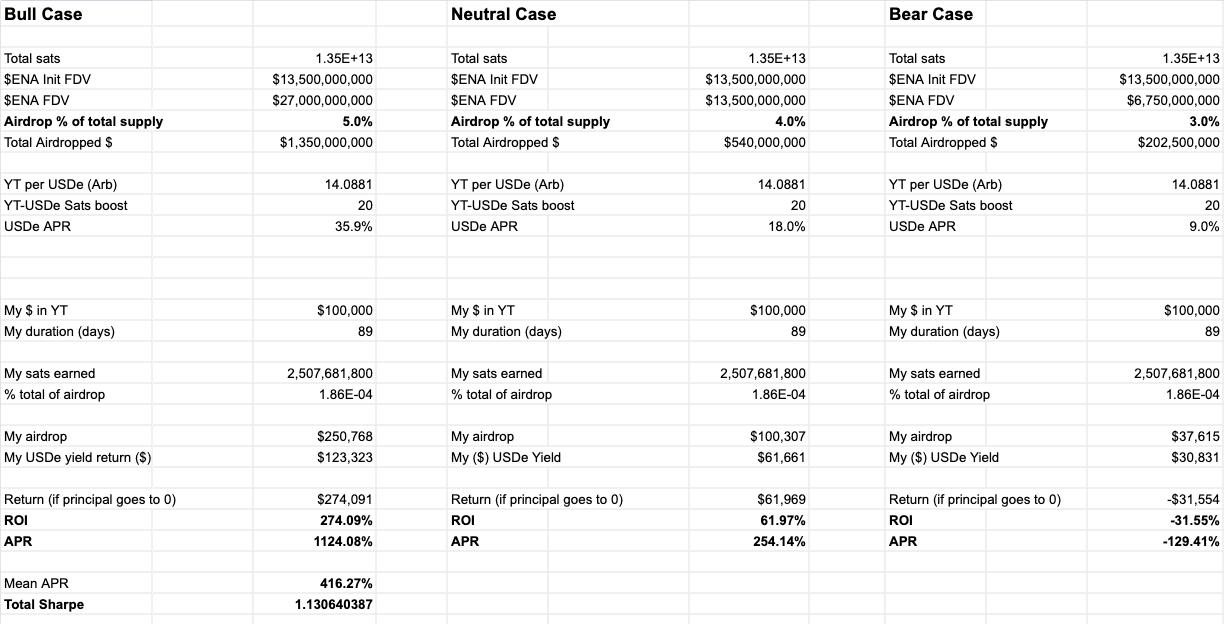

Below is a snapshot of the inputs and the computed ROI for each case as well as the mean APR of the strategy and aggregate Sharpe over all three scenarios:

As you can see the upside and mean APR of this strat are monstrous. However there is also a huge potential loss with an ROI of -31.55% in the bearish case. The total sharpe is 1.13 which is not bad, however we can do better.

Conclusion

Going long on YT-USDe on Pendle is a speculative yet potentially high-reward strategy that leverages the value of the Ethena airdrop and the yield from USDe. This approach offers significant potential returns but comes with several unknowns, such as the exact percentage of the airdrop and the total number of Sats minted. Investors considering this strategy should be prepared for active management and a higher degree of risk to capitalize on the opportunities presented during Points Season 2.

Strategy 4: Hedged YT-USDe with ENA Perpetual Futures

For investors seeking to maximize returns while mitigating downside risk, a promising approach involves holding YT-USDe tokens and hedging with ENA perpetual futures, similar to what we discussed for the hedged PT-ENA strategy. This strategy not only captures the yield from USDe but also leverages the funding rate from perpetual futures and neutralizes potential losses if the price of ENA drops.

Overview of the Hedged YT-USDe Strategy

This strategy combines the high-yield potential of YT-USDe with a risk management component by using ENA perpetual futures. By doing so, you should be able to protect yourself from price volatility in ENA while benefiting from the funding rates offered by the futures market.

Potential Returns

Leveraged Yield Play: By holding YT-USDe, investors gain exposure to the yield and points generated by USDe. This yield can be substantial, particularly during Points Season 2, which includes additional rewards from the airdrop.

Funding Rate Income: Hedging with ENA perpetual futures allows investors to earn the funding rate, which can add up to and extra 30% to 150% APR. This funding rate income provides an additional layer of returns beyond the yield from YT-USDe and can offset the increased capital drag of this strategy due to the need to post margin.

Risk Mitigation: Using ENA perpetual futures to hedge neutralizes the downside risk associated with a drop in the price of ENA. This means that if ENA’s price falls, the losses on YT-USDe can be offset by gains from the short futures position.

Risks and Unknowns

Airdrop Percentage: The exact percentage of the airdrop and the total number of tokens distributed can vary, affecting the overall returns.

Total Sats Minted: The total number of Sats produced and available for distribution during Points Season 2 is another variable that can impact potential returns. The exact number of Sats minted will determine the overall reward pool and how it is distributed among participants.

Funding Rate Fluctuations: The funding rate on ENA perpetual futures can fluctuate based on market conditions. While it can add significant returns, it is not guaranteed and can vary over time.

Complexity and Active Management: This strategy requires active management to ennsure enough margin is posted to avoid liquidations. In the case of large price swings, margin requirements can increase substantially adding additional capital drag that may dilute this strats APR.

Implementation

Purchase YT-USDe: Acquire YT-USDe tokens on the Pendle platform. Ensure you understand the current market conditions and the potential yield.

Open ENA Perpetual Futures Position: Open a short position in ENA perpetual futures to hedge against potential downside risk in ENA’s price. This involves selling ENA futures contracts to offset potential losses from YT-USDe.

Monitor Market Conditions: Regularly monitor the market prices of USDe and ENA, the funding rates on ENA perpetual futures, and any updates regarding the airdrop and yield generated by USDe.

Adjust Holdings: Be prepared to adjust your futures positions based on market movements and new information about the airdrop and yield. Continuous monitoring and active management are essential to avoiding liquidation.

Probabilistic Analysis

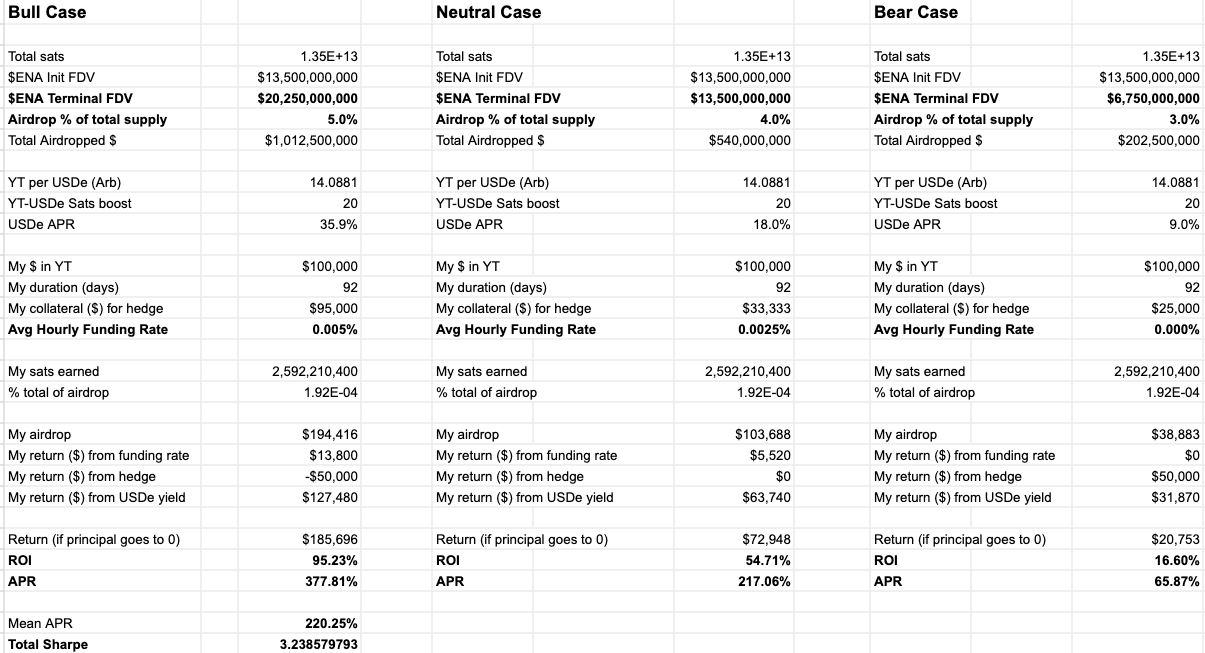

Considering again the three scenarios of Bull, Nuetral and Bear we find the following:

As in the hedged PT-ENA strat the upside is lower but so is the downside. With a mean APR of 220% and a sharpe of 3.28 we find this to be a compelling option.

Conclusion

The hedged YT-USDe strategy with ENA perpetual futures is a sophisticated approach that combines high yield potential with effective risk management. By capturing the yield from USDe, earning funding rate income, and neutralizing downside risk, this strategy offers a balanced yet high-reward investment option during Points Season 2. While it requires active management and comes with several uncertainties, the potential for significant returns makes it an attractive choice for experienced investors looking to optimize their yield while mitigating risk.

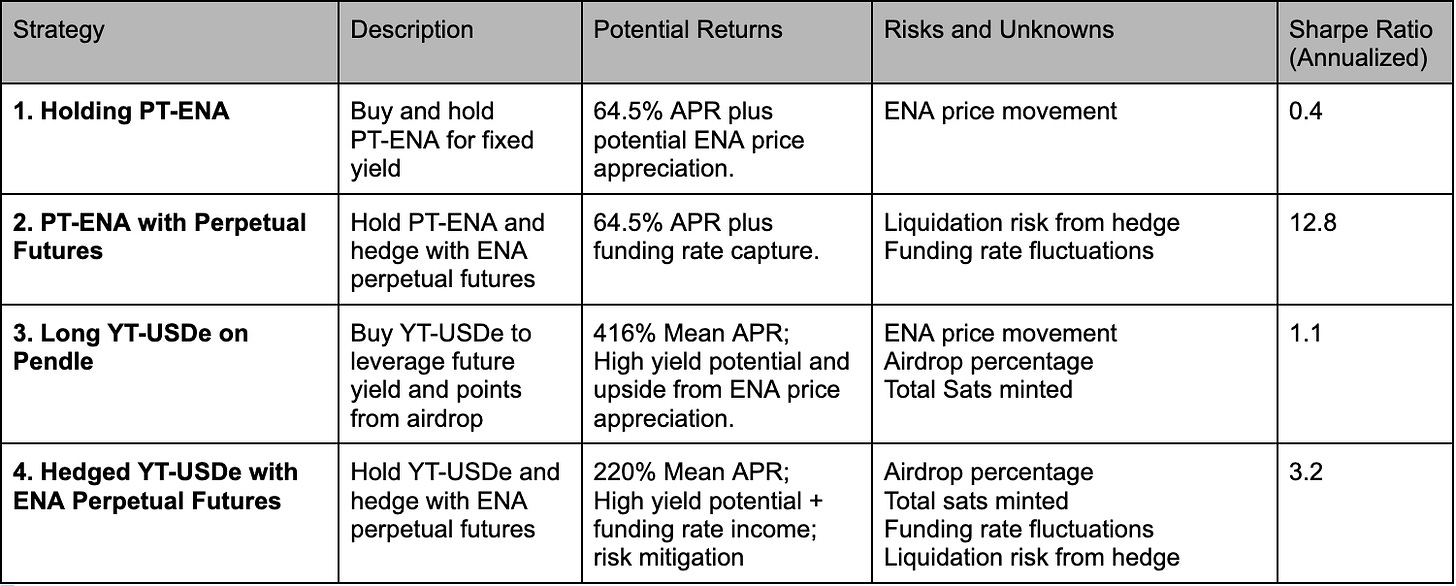

Strategy Comparison Table

The table below summarizes the key aspects, potential returns, risks, and management requirements for each of the six strategies discussed. This comparison should help you choose the most suitable strategy based on their risk tolerance, investment goals, and management capabilities. However, this is not investment advice, as always do your own research.

This table provides a comprehensive comparison of the six strategies, highlighting their respective benefits, risks, and management requirements. Investors can use this information to choose the strategy that best aligns with their investment objectives and risk tolerance during Ethena's Points Season 2.

Our Top Picks

Among the various strategies evaluated, our top pick is Strategy 2: Holding PT-ENA and hedging with ENA perpetual futures. We believe this strategy offers the best risk-reward profile, making it the most suitable choice for most during Ethena's Points Season 2.

Our second pick is Strategy 4: Hedged YT-USDe with ENA Perpetual Futures as it offers a much higher potential return while keeping the risk at acceptable levels.

We have decided we will be putting our money where our mouth is by placing bets in both strategies.

Closing Remarks

Pendle is a great way to play different yield and airdrop opportunities. However, rigorous analysis is recommended as both the upside and downside are highly sensitive to the details and model inputs.

The spreadsheeet containing the above analysis as well as a few additional strats we discarded for brevity is available here. Feel free to play around with the model assumptions.

If you are a fellow whale or institution, we provide consultations and in depth analysis on a personalized basis. Please reach out if interested.