Unlocking Superior Returns During EtherFi Season 2: Three Advanced Yield Strategies

Introduction

In the ever-evolving landscape of decentralized finance (DeFi), crypto whales are continually seeking innovative strategies to enhance their portfolios. One such strategy involves leveraging EtherFi's Wrapped Ether (weETH) and engaging in points farming.

These methods have gained traction due to their potential for high returns and flexibility in the DeFi ecosystem. This article delves into the intricacies of EtherFi weETH and points farming, offering insights and actionable strategies for unlocking substantial returns.

Disclaimer

Nothing on this site is to be construed as investment or financial advice. Please consult a financial advisor and do your own research before making any investment decisions.

Understanding EtherFi and weETH

EtherFi is a decentralized finance (DeFi) platform that enhances Ethereum staking by introducing innovative staking and restaking mechanisms. At its core, EtherFi aims to make Ethereum staking more accessible and rewarding through its suite of products and services.

Central to EtherFi's ecosystem is eETH, a native liquid restaking token. When users stake their ETH through EtherFi, they receive eETH, which not only accrues staking rewards but also allows for additional earning opportunities through restaking on EigenLayer. This enhances the overall yield for stakers by leveraging multiple layers of staking rewards.

weETH is the wrapped, non-rebasing version of eETH, designed to integrate seamlessly into the broader DeFi ecosystem. This allows users to utilize their staked assets in various DeFi applications without losing the benefits of staking rewards. This dual functionality of staking and liquidity provision makes weETH a powerful tool for maximizing returns.

Overview of the EtherFi Points Season 2

EtherFi Points Season 2 is an exciting period for users to maximize their rewards through strategic staking and participation in the EtherFi ecosystem. Running from March 15 to June 30, 2024, this season offers enhanced loyalty rewards and various incentives to encourage active engagement.

Key Features of the Points Season

1. Enhanced Staking Rewards: Participants earn loyalty points by staking ETH and receiving eETH or weETH, which can be used across DeFi protocols. These points not only accrue staking rewards but also benefit from restaking through EigenLayer, providing an additional layer of rewards.

2. StakeRank System: Introduced on March 25, 2024, StakeRank is a tiered level system that rewards users for staking their ETH longer. There are 8 ranks, with each rank offering progressively higher loyalty points rate boosts. Users advance one rank every 100 hours of staking, provided their balance remains above 0.1 eETH.

3. Loyalty Points Multipliers: The loyalty points earned after March 15 receive a 10x boost compared to Season 1. This significant increase aims to reward both returning users and new participants, ensuring a fair distribution of rewards.

4. Airdrop Eligibility: A 5% allocation of the total ETHFI token supply is dedicated to Season 2 participants. To be eligible for the airdrop, users must actively stake during the season and adhere to specific conditions, such as maintaining a minimum staking balance and avoiding withdrawals close to the season's end.

5. Integration with DeFi Protocols: EtherFi has integrated with various DeFi protocols, allowing users to earn additional points through liquidity provisioning, referrals, and participating in ecosystem events. Points are granted based on the user's eETH/weETH balance, whether held directly or in participating protocols.

Points Season Rules and Conditions

Season 2 Rules:

Staking 0.001 ETH earns 10 points per day.

Users advance in StakeRank every 100 hours of staking.

Loyalty points accrued from Season 1 are diluted but still count towards Season 2 rewards under specific conditions.

Risk Considerations:

Points tracking ratios in liquidity pools can change, affecting the number of points earned.

Users must consider these fluctuations when strategizing to maximize points.

For more detailed information and updates on the EtherFi Points Season, visit EtherFi GitBook - Loyalty Points.

Strategy 1: Loop Trade on Mendi Finance (Linea)

Our first strategy is also the most conservative one, it is a loop trade on Mendi Finance. This is a semi-advanced method designed to maximize EtherFi points by leveraging both supplying and borrowing of weETH. In addition to EtherFi points one is also earning:

Eigenlayer points

Linea Surge XP points.

Mendi rewards.

Here’s a detailed breakdown of how to execute this strategy:

Step-by-Step Guide

1. Initial Setup:

Deposit weETH: Start by supplying your weETH into Mendi Finance as collateral.

2. Borrowing and Re-Supplying:

Borrow weETH: Use your initial supply as collateral to borrow additional weETH.

Re-Supply: Supply the borrowed weETH back into the platform as collateral.

3. Repeating the Loop:

Cycle Repetition: Continue the borrowing and re-supplying cycle multiple times to maximize the accumulation of points until you reach an LTV you are comfortable with. (Personally we are comfortable with a near-max LTV as we frequently monitor our positions and do not borrow additional assets, which would increase the liquidation risk from price fluctuations.)

Multiplier Effect

This strategy is particularly effective due to the high multiplier effect it offers. By engaging in multiple cycles of borrowing and re-supplying, you can amplify your EtherFi points up to 6x, and your EigenLayer points up to 3x, significantly boosting your rewards. This is on top of the earnings from both Mendi rewards and the Linea points campaign.

Risk Management

While the Mendi loop trade strategy offers high returns, it comes with inherent risks:

Liquidation Risk: The cyclical nature of borrowing and re-supplying increases the risk of liquidation due to changes in interest rates on Mendi. However by periodically monitoring rates and LTV you should be able to neutralize this risk. This risk is further increased if you are borrowing other assets than weETH, as then there is liquidation risk from price movements as well.

Smart Contract Risk: The strategy involves multiple protocols (Mendi Finance, EtherFi, EigenLayer), each with potential vulnerabilities in their smart contracts. In particular Mendi Finance is a Compound V2 fork with known bugs. If deploying significant amounts it is imperative to have a sniping bot deployed that will exit the position when certain special criteria are met. We will cover this in a future article. In the meantime, feel free to contact us if you need this information sooner.

Price Risk: Changes in the fully diluted value (FDV) of EtherFi and fluctuations in EigenLayer prices can impact the strategy’s profitability.

Points Risk: Points campaigns come with several risks, including but not limited to:

Unexpected inflation of points, which can devalue the rewards.

Delays in converting points to liquid tokens due to lockup periods or postponed token generation events.s.

Financial Analysis

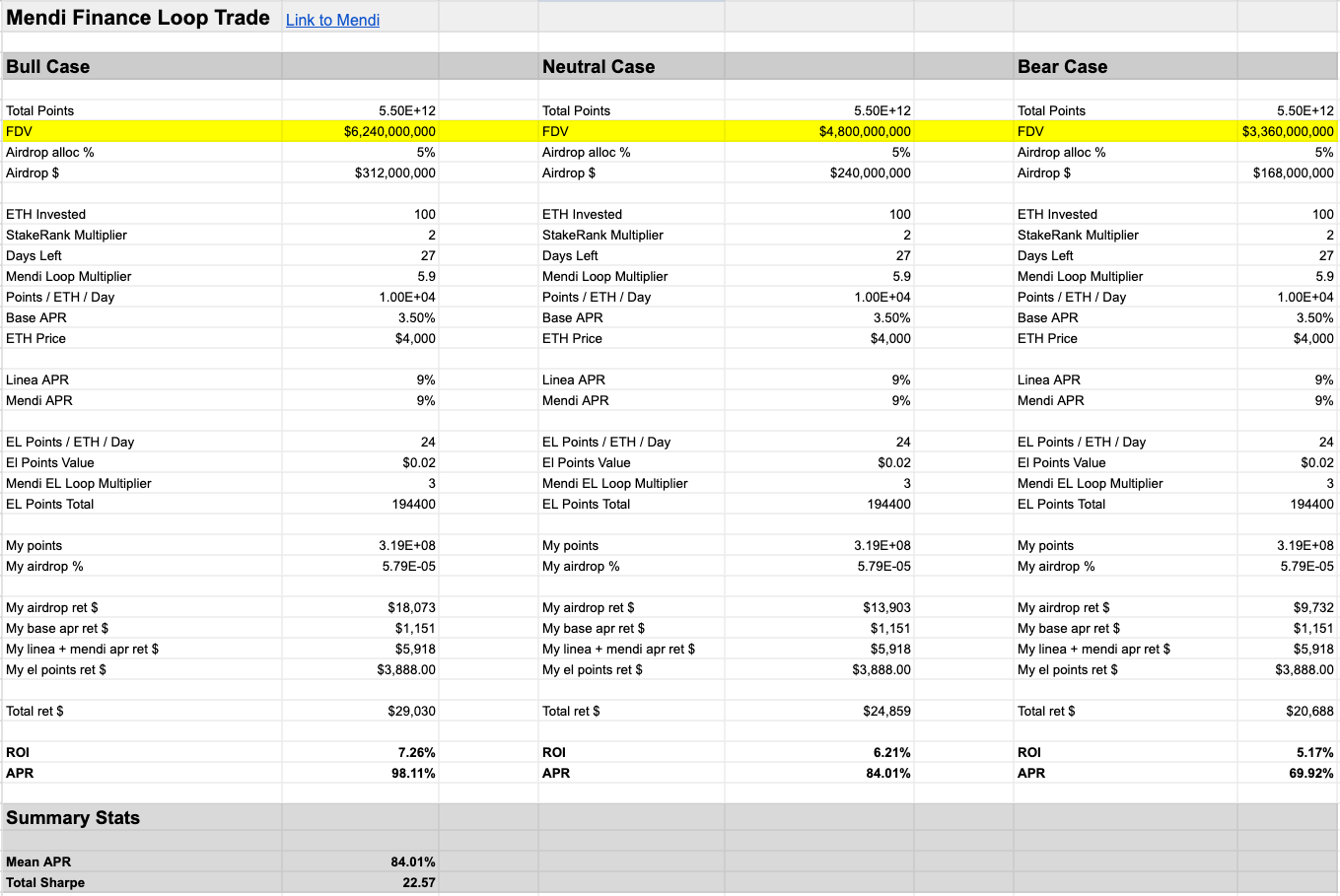

We consider a model investment of 100 ETH across three different scenarios: bull, neutral and bear:

As one can see from the above analysis the mean APR of 84.01% and Sharpe of 22.57 implies a highly attractive risk reward profile in the the presence of significant market fluctuations of EtherFi’s FDV.

Unlike the following two strategies, this strategy has the feature of being less dependent on EigenLayer points to generate a return. The principal is also relatively insensitive to movements in EtherFi’s FDV as long as weETH maintains its peg.

Strategy 2: Pendle YT-weETH on Mainnet

The Pendle YT-weETH strategy leverages the unique features of Pendle Finance to maximize EtherFi points by using Yield Tokenized (YT) weETH. This approach allows investors to benefit from the yield-bearing capabilities of weETH while optimizing their points accumulation in a leveraged manner.

Step-by-Step Guide

Acquire YT-weETH: Obtain YT-weETH through Pendle Finance (pool link here). This is done by swapping weETH for YT-weETH.

Monitor position. If you desire you may wish to monitor the value of your YT-weETH and exit the trade early to collect profits or cut losses. Otherwise just wait for maturity.

Claim airdrop and yield. YT-weETH approaches zero value on maturity. However what you gain in exchange are the rights associated with any yield and airdrops (Ether Fi and EigenLayer) associated with the weETH. You can periodically check in and claim the yield and airdops as they become available.

Risk Management

While this strategy offers significant earning potential, it also comes with specific risks:

Smart Contract Risk: Vulnerabilities in Pendle’s or EtherFi’s smart contracts.

Market Risk: Fluctuations in the price of the FDV of Ether Fi, Eigenlayer, and weETH are significant risks.

Points Risk: Points campaigns come with several risks, including but not limited to:

Unexpected inflation of points, which can devalue the rewards.

Delays in converting points to liquid tokens due to lockup periods or postponed token generation events.

Financial Analysis

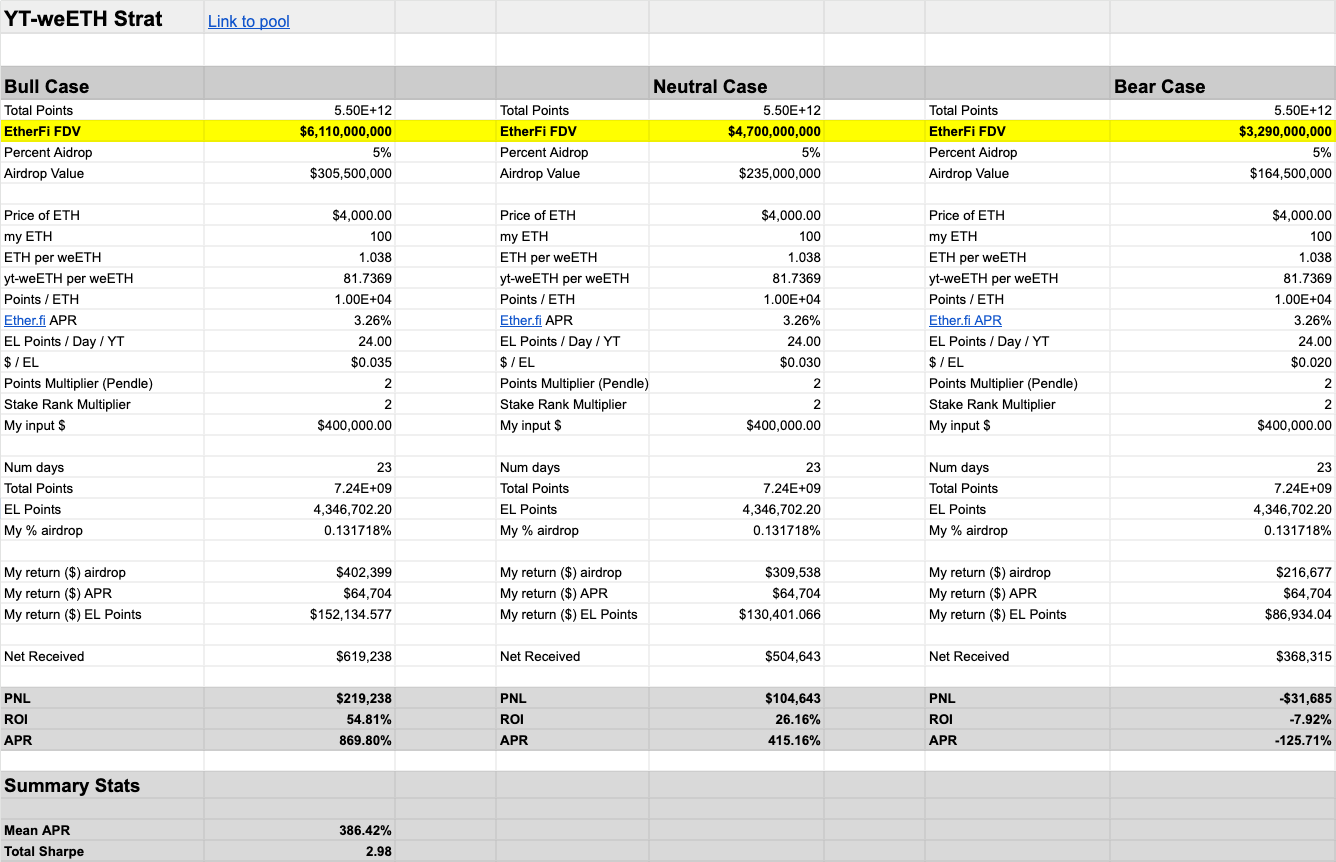

Implementing the Pendle YT-weETH strategy can lead to substantial returns. Here’s an overview of potential outcomes based on three market scenarios - bull, neutral and bear:

This strategy’s mean APR is 386.42%, with a total Sharpe ratio of 2.98, indicating high potential returns relative to risk. This strategy is however, significantly more sensitive to the value of both EtherFi and Eigenlayer points than the Mendi loop trade strategy. This is reflected in a lower Sharpe ratio.

Strategy 3: Pendle YT-weETH (Zircuit)

The Pendle YT-weETH (Zircuit) strategy is a variation designed to speculate on the Zircuit airdrop in addition to Ether Fi and Eigenlayer point accumulation during EtherFi Season 2. This approach utilizes the Zircuit platform to optimize yield and leverage additional multipliers.

For more information about Zircuit, visit Zircuit.

Step-by-Step Guide

Acquire YT-weETH: Begin by swapping weETH for YT-weETH(Zircuit) (pool link here).

Monitor position. If you desire you may wish to monitor the value of your YT-weETH (Zircuit) position and exit the trade early to collect profits or cut losses. Otherwise just wait for maturity.

Claim airdrop and yield. YT-weETH (Zicruit) approaches zero value on maturity. However what you gain in exchange are the rights associated with any yield and airdrops (Ether Fi, EigenLayer and Zircuit) associated with the weETH. You can periodically check in and claim the yield and airdops as they become available.

Risk Management

This strategy also carries specific risks:

Smart Contract Risk: Potential vulnerabilities in Pendle, EtherFi, and Zircuit smart contracts.

Market Risk: Fluctuations in the price of the FDV of Ether Fi, Eigenlayer, and weETH are significant risks.

Zircuit Airdrop Uncertainties. This strategy is a significant bet on the value of Zircuit points. Zircuit has not announced the date of their airdrop and information regarding the value of points is scarce, so this is a particularly big unknown.

General Points Risk: Points campaigns come with several risks, including but not limited to:

Unexpected inflation of points, which can devalue the rewards.

Delays in converting points to liquid tokens due to lockup periods or postponed token generation events.

Financial Implications

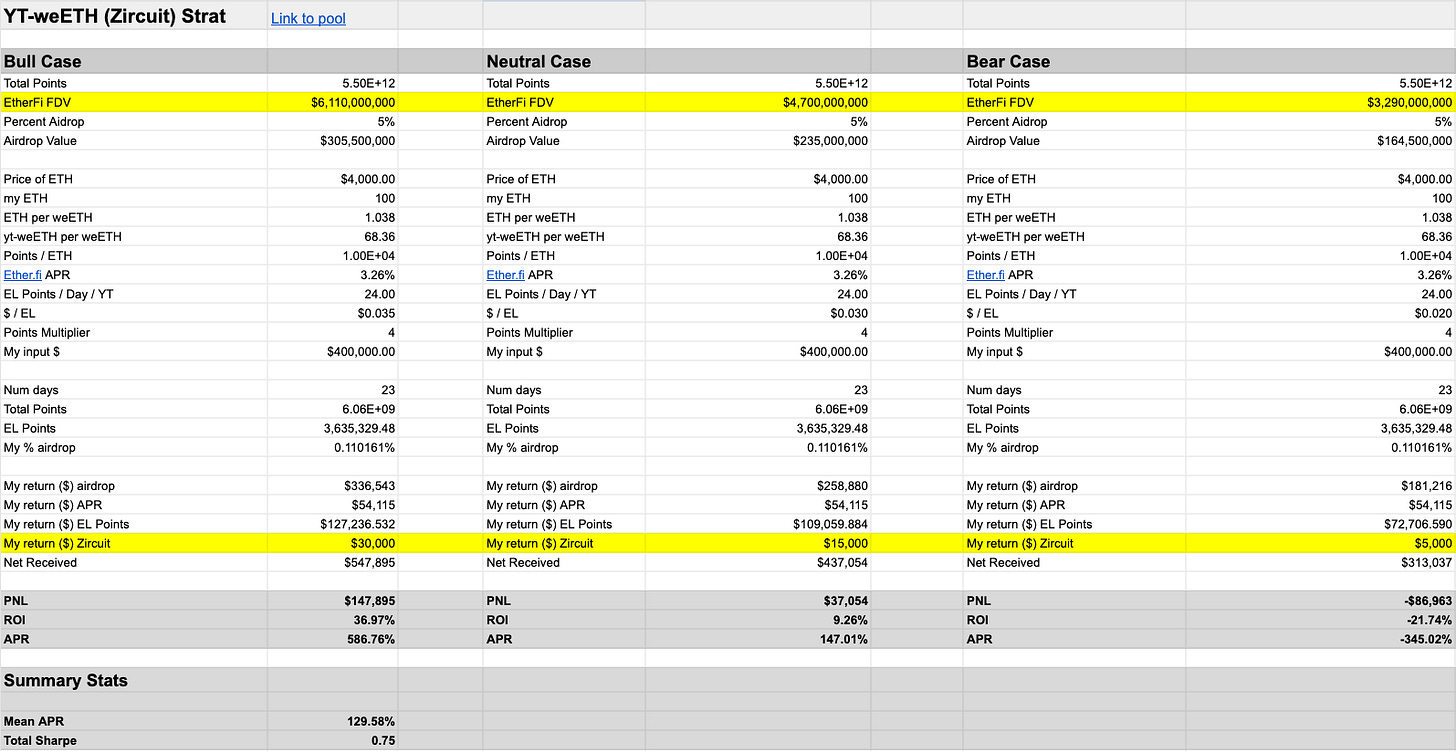

Implementing the Pendle YT-weETH (Zircuit) strategy can lead to significant returns. Here’s an overview based on different market scenarios, bull, neutral and bear:

This strategy’s mean APR is 129.58% with Sharpe of 0.75. Both the APR and Sharpe are lower than those of Strategy 2 due to the uncertainty around Zircuit points and our defensive take on their value. This highlights the importance of careful risk management and further research before blindly chasing higher returns.

This strategy would make most sense for investors who are particularly bullish on Zircuit, perhaps due to an informational edge on the Zircuit drop.

Our Picks: Where We Are Putting Our Money

Our top picks for maximizing returns during EtherFi Season 2 are Strategy 1: Loop Trade on Mendi and Strategy 2: Pendle TY-weETH on Mainnet. We have allocated funds to both strategies, given their potential for high returns and robust performance.

While Strategy 3: Pendle YT-weETH (Zircuit) presents an intriguing opportunity, we currently lack sufficient information about the Zircuit airdrop to make a confident investment. As a result, we will either make a minimal allocation to this strategy or choose to pass on it entirely. This cautious approach ensures that we focus our resources on strategies with clearer and more predictable outcomes.

If you have any questions, feel free to reach out.

Additional Resources

For further reading and tools to help you navigate EtherFi Season 2, check out the following resources:

These resources will provide you with the necessary information and tools to successfully implement the strategies discussed and maximize your returns during EtherFi Season 2.

Remarks About Methodology

In the above we include detailed analysis on a few different strategies, including expected returns and Sharpe rations. A few remarks on the methodology we used to estimate strategy performance.

Total Points Estimates

Crucial to the below strategies is an estimate of total points emissions. We generally prefer to use conservative estimates which likely overestimate points and this time is no exception. You can play around with our points estimate model and assumptions in our spreadsheet here.

Stake Rank

In the EtherFi strategies discussed, we are assuming a Stake Rank multiplier of 2. This multiplier is crucial for our calculations and may not apply to your portfolio, depending on your prior interactions with EtherFi. Your individual multiplier can vary based on your engagement level and history with the platform. Therefore, it is important to verify your specific Stake Rank multiplier and take this account into your return calculations before making any investment decisions based on these strategies.

You can play around with our models, including changing the stake rank multiplier in our spreadsheet models here.